BTC Price Prediction: Navigating Volatility from $87K to Future Horizons

#BTC

- Critical Technical Level: Bitcoin's immediate battle is to reclaim its 20-day moving average near $90,300. Failure could lead to a test of lower Bollinger Band support around $82,700, defining the short-term trend.

- Clash of Fundamentals: The market sentiment is torn between strong institutional adoption signals (e.g., Bank of America, Vanguard) and macroeconomic headwinds like bond yields and Fed policy uncertainty, leading to consolidation.

- Long-Term Scarcity Narrative: Despite near-term volatility, the long-term forecast remains anchored to Bitcoin's fixed supply and growing adoption as a digital hard asset, with price projections rising significantly per halving cycle over decades.

BTC Price Prediction

Technical Analysis: BTC at Critical Juncture Below Key Moving Average

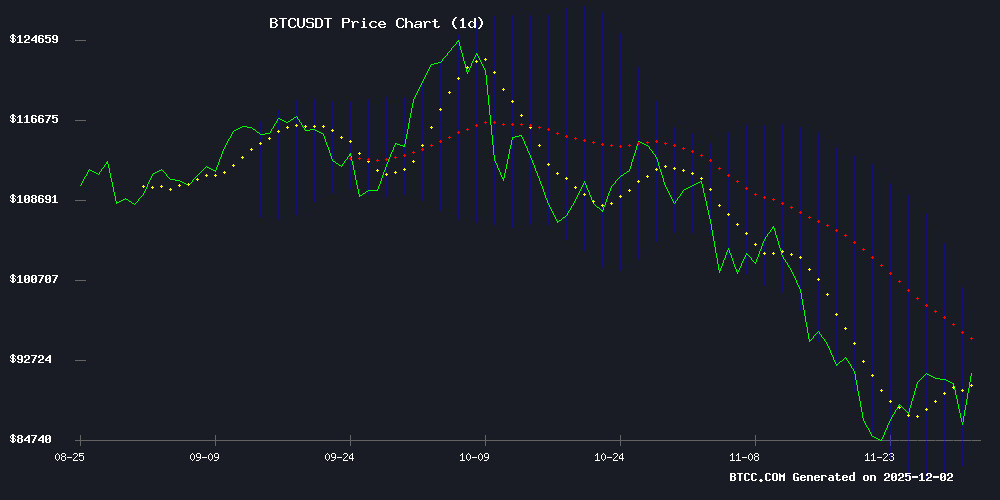

According to BTCC financial analyst James, Bitcoin's current price of $86,912 sits below its 20-day moving average of $90,347, indicating a short-term bearish momentum. The MACD reading of -1,617 shows the signal line is below the MACD line, confirming this negative near-term bias. However, James notes that the price remains above the lower Bollinger Band at $82,762, which could act as immediate support. A sustained break below this level WOULD signal a deeper correction, while a reclaim of the 20-day MA could shift momentum back to the bulls.

Market Sentiment: A Battle Between Institutional Adoption and Macroeconomic Headwinds

BTCC financial analyst James interprets the news flow as creating a conflicted sentiment. Positive catalysts like Bank of America and Vanguard embracing Bitcoin ETFs represent significant institutional validation and potential new capital inflows. Conversely, headlines about Bitcoin's recent 30% plunge, macro fears, and dormant wallet movements inject volatility and uncertainty. James believes the market is in a consolidation phase, digesting these opposing forces. The resurgence of dormant coins can pressure prices in the short term but also signals awakening long-term holder interest.

Factors Influencing BTC’s Price

Dormant Satoshi-Era Bitcoin Wallet Resurfaces, Moves $4.3M in BTC

A Bitcoin wallet inactive since the cryptocurrency's infancy transferred 50 BTC ($4.33 million) this week, stirring speculation among traders. The wallet dates to March 2010—when Bitcoin's network comprised fewer than 100 users and mining operations were nascent.

Such movements often signal potential selling pressure, as early adopters capitalize on Bitcoin's 100,000%+ appreciation since the 'pizza transactions' era. The coins originated from mining rewards when blocks yielded 50 BTC—now worth 3,000x their initial value.

Market observers track these resurrections closely: dormant supply shocks can precede volatility. This transfer follows Bitcoin's 60% YTD rally, testing all-time highs amid institutional ETF inflows.

Bitcoin's 30% Plunge Defies Fed Rate Cuts as Bond Yields Hold Firm

Bitcoin’s 30% drop from its October peak underscores a market anomaly: traditional correlations between Fed policy and risk assets are breaking down. The cryptocurrency now trades near $87,000 despite the central bank’s rate-cutting cycle, which historically buoyed speculative investments.

Ten-year Treasury yields remain stubbornly above 4%, climbing 50 basis points since September’s initial Fed cut. This divergence reflects mounting fiscal concerns as debt issuance overwhelms demand. Japan’s potential rate hike and resilient dollar index further complicate the landscape.

‘Markets are rewriting the playbook,’ observes a Goldman Sachs strategist. With December’s anticipated 25-basis-point cut unlikely to ease bond market pressures, cryptocurrencies face headwinds beyond monetary policy alone.

Bank of America Opens Crypto Floodgates for Wealth Clients with 4% Bitcoin ETF Allocation

Bank of America has pivoted decisively toward cryptocurrency adoption, authorizing wealth management clients to allocate 1-4% of portfolios to bitcoin ETFs through its Merrill and Private Bank platforms. The move follows months of internal deliberation and reflects growing institutional acceptance of digital assets as portfolio diversifiers.

Starting January 5, the bank will facilitate exposure through four bitcoin ETFs: Bitwise, Fidelity, Grayscale, and BlackRock products. This structured approach contrasts with previous ad-hoc crypto access available only upon client request. The 4% ceiling aligns with recommendations from Morgan Stanley (2-4%), while remaining more conservative than Fidelity's 5% upper bound.

The policy shift arrives amid bitcoin's 32% retreat from its October peak above $126,000 to current $85,000 levels. Bank of America's $2.9 trillion asset base lends institutional credibility to crypto allocations previously considered niche.

Dormant Bitcoin Miner Moves 50 BTC After 15 Years of Silence

A Bitcoin wallet, inactive for over 15 years, suddenly transferred its entire 50 BTC balance this week. The transaction occurred against a backdrop of heightened market volatility and renewed pressure on cryptocurrency prices.

The movement of such a long-dormant holding has sparked speculation among analysts. Some interpret it as a sign of shifting sentiment among early adopters, while others view it as a routine portfolio adjustment.

Powell's Silence Sparks Bitcoin Rally Amid Rate Cut Uncertainty

Federal Reserve Chair Jerome Powell avoided monetary policy commentary during a Stanford University speech, creating market ambiguity ahead of the December meeting. Bitcoin surged past $87,000 as investors interpreted the silence as a temporary reprieve from hawkish signals.

Weak economic data fueled speculation of delayed rate cuts, with Powell adhering to the Fed's quiet period protocol. The strategic omission left traders parsing earlier statements suggesting uncertainty about December policy moves.

Market liquidity concerns emerged as the speech coincided with the end of quantitative tightening. Bitcoin's rally defied traditional correlation patterns, highlighting crypto's evolving role as a macroeconomic hedge.

Bitcoin Tumbles 8% Amid Macro Fears, Crypto Stocks Routed

Bitcoin plunged to $84,000 in its sharpest single-day drop since March, rattled by speculation of impending rate hikes in Japan. The move threatens to unwind yen carry trades that have buoyed risk assets—a pattern last seen in August 2024 when BTC collapsed 18% in days.

MicroStrategy’s 130-BTC purchase failed to stem its stock’s 40% monthly slide, while crypto equities bled: Coinbase (-20%), Circle (-38%), Robinhood (-16%). Bitcoin ETFs bled $3.5 billion in November—their second-worst month on record—as the token retreated 30% from October’s peak.

Analysts see turbulence ahead but note a true crash would require Bitcoin breaking $12,700—a scenario needing multiple macro shocks. The market now watches for whether today’s selloff mirrors August’s transient panic or something darker.

Bitcoin Rebounds to $87K After 7% Selloff as Market Awaits Fed Decision

Bitcoin clawed back above $87,000 after Monday's 7% plunge below $84,000, its steepest single-day drop in months. The recovery remains fragile as spot Bitcoin ETFs bleed assets and November marks BTC's worst monthly performance since 2019.

All eyes turn to next week's FOMC meeting, where an 87% probability of rate cuts contrasts with Fed Chair Powell's reticence during Stanford remarks. Manufacturing data underscores the tension - the ISM PMI contraction extended to nine months at 48.2.

The crypto market's sensitivity to macro forces was laid bare this week. Traders now weigh whether Bitcoin's rebound signals resilience or a dead-cat bounce amid evaporating ETF demand.

Vanguard Opens Doors to Bitcoin and Crypto ETFs After Years of Resistance

Vanguard, the $11 trillion asset management giant, has reversed its longstanding stance against cryptocurrency by enabling client access to Bitcoin and crypto-related ETFs. The move signals a watershed moment for institutional adoption, reflecting mounting pressure from both retail and professional investors seeking exposure to digital assets.

The policy shift comes as spot Bitcoin ETFs accumulate record inflows and traditional finance increasingly views crypto as a legitimate asset class. Vanguard's decision removes a significant barrier to entry for conservative investors who previously lacked trusted avenues for crypto exposure through mainstream platforms.

Bitcoin Price Prediction: Critical Support Zone Tests Market Sentiment

Bitcoin hovers near an eight-month low, teetering between stabilization and further downside. The $83,500–$85,500 demand zone has emerged as a battleground, with aggressive spot buying clashing against persistent selling pressure. Traders are scrutinizing liquidity flows and whale activity for clues on whether this marks a bottom or a pause before deeper losses.

Technical indicators paint a mixed picture. The 4-hour MACD shows weakening bearish momentum, while the stochastic RSI hints at building upside potential. But until BTC decisively reclaims key resistance levels, the rebound remains fragile—a volatile consolidation rather than a confirmed trend reversal.

Strategy Builds $1.44B War Chest While Doubling Down on Bitcoin

Strategy has amassed a $1.44 billion reserve through Class A common stock sales, creating a liquidity buffer covering 21 months of dividend obligations. The reserve represents 2.2% of enterprise value and 2.4% of BTC holdings.

Despite equity market turbulence, the company continues accumulating Bitcoin, adding 130 BTC to its treasury. This reflects institutional conviction in cryptocurrency as a strategic reserve asset during traditional market volatility.

The capital allocation strategy demonstrates a dual focus: maintaining traditional financial stability while positioning for digital asset growth. Market observers note this mirrors broader institutional trends of hedging fiat exposure with crypto reserves.

Bitcoin Bulls Confront Treasury Signals on Rate Cut Hopes

Bitcoin advocates are closely monitoring the potential impact of interest rate cuts on the cryptocurrency's value. Expectations of reduced bond yields and a weaker dollar have fueled bullish sentiment, but recent signals from the U.S. Treasury suggest a more cautious outlook. The timing and likelihood of rate cuts remain uncertain, leaving investors in a holding pattern.

Foreign exchange markets add another layer of complexity. A resilient dollar has dampened hopes for a immediate boost to Bitcoin's appeal. The interplay between fiscal policy and currency dynamics will likely dictate the near-term trajectory for crypto markets.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on the current technical posture and mixed fundamental backdrop, BTCC financial analyst James provides the following forward-looking assessment. It's crucial to understand that long-term cryptocurrency forecasting is inherently speculative and subject to dramatic change based on adoption, regulation, and macroeconomic conditions.

| Year | Price Forecast Range | Primary Catalysts & Considerations |

|---|---|---|

| 2025 | $75,000 - $120,000 | Near-term trajectory hinges on reclaiming the 20-day MA ($90,347). Failure could test support near $82,700. Upside depends on sustained institutional ETF inflows offsetting macro concerns and sell-pressure from reactivated wallets. |

| 2030 | $180,000 - $350,000 | This period is expected to be driven by broader institutional integration, potential regulatory clarity in major economies, and the next Bitcoin halving cycle (2028). Adoption as a digital reserve asset could accelerate. |

| 2035 | $400,000 - $800,000+ | Predictions become more theoretical. Value will be driven by Bitcoin's established role in the global financial system, scarcity narrative post-multiple halvings, and its adoption as a hedge against currency debasement. |

| 2040 | $1,000,000+ (Scenario Dependent) | This horizon depends on Bitcoin becoming a universally recognized store of value. Price would reflect its fixed supply against expanded global wealth. Reaching this tier requires mass adoption and minimal viable competition from other digital assets. |

James emphasizes that these ranges are not targets but plausible scenarios based on current trends. The path will be non-linear, marked by significant volatility. Investors should focus on the underlying technology and adoption metrics rather than short-term price fluctuations.